Tom DeMark Sequential is a famous indicator in professional financial package like Bloomberg and Reuters. Kurt Magnus, head of Forex sales at Westpac bank in London said that it was 70% reliable, and even closer to 90% in Forex.

It arouses my interest to see if it can be used in Hang Seng Index. I developed my indicator based on Tom DeMark's published theory and back test it for 20 years of Hang Seng Index Daily data captured from Yahoo. My stop loss is a little different from Tom's theory. Instead of waiting the daily price closing to confirm stop loss, I trigger the stop loss immediately when it reaches. My target is based on the lowest price value from the beginning of the setup to the end of the countdown for long trade, and the highest price value for short trade.

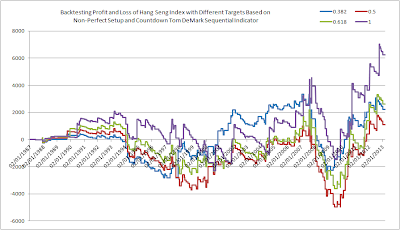

Then I look for 0.382, 0.5, 0.618 and 1 times of the target value from the order placement price. The following two charts respectively plot the profit and loss over the test period for Non-Perfect and Perfect Setup and Countdown similar to Tom's theory. It can be seen that a larger target has higher profit no matter whether it is perfect or not. Besides, the perfect setup and countdown is not guaranteed to more profit over the period. However, the profit gained over the years is not impressing compared to the gain of the Hang Seng Index itself in the same period.

More results will be posted later.

No comments:

Post a Comment